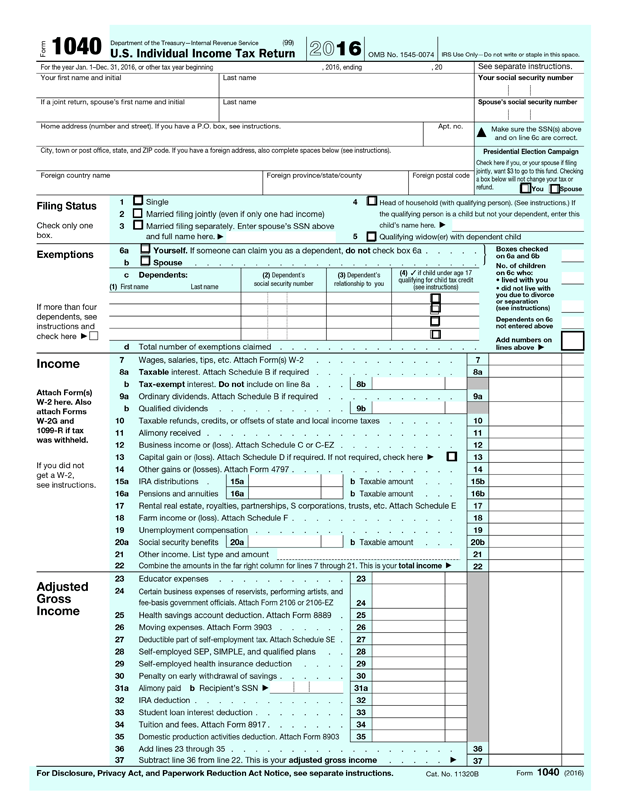

11320 Bįorm 1040 (2022) Go to 1040 for instructions and the latest information. Also c Tip income not reported on line 1 a (see instructions) attach Forms d Medicaid waiver payments not reported on Form(s) W-2 (see instructions) For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040 (Schedule 1) Additional Income and Adjustments to Income. Form 1040 (PR) (Schedule H) Household Employment Tax (Puerto Rico Version) 2022. b Household employee wages not reported on Form(s) W-2. Federal Self-Employment Contribution Statement for Residents of Puerto Rico. To help you understand why we ask for certain permissions, we’ve provided a breakdown of the usage. When installing IRS2Go, you may see a list of Android permissions that the app requests. IRS2Go is the official app of the Internal Revenue Service. You can also access prior years returns that you filed with us. You can use these steps to view your return while you’re still working on it. Go to this section in Credit Karma Tax: View tax return forms. Digital At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services) or (b) sell, Assets exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) □ Yes □ No Standard Someone can claim: □ You as a dependent □ Your spouse as a dependent Deduction □ Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: □ Were born before Janu□ Are blind Spouse: □ Was born before Janu□ Is blind Income 1a Total amount from Form(s) W-2, box 1 (see instructions). Download IRS2Go and connect with the IRS whenever you want, wherever you are. Once you have e-filed your taxes, you can download your return from the dashboard.

0 kommentar(er)

0 kommentar(er)